Council to vote on lower tax levy

City News December 5, 2025

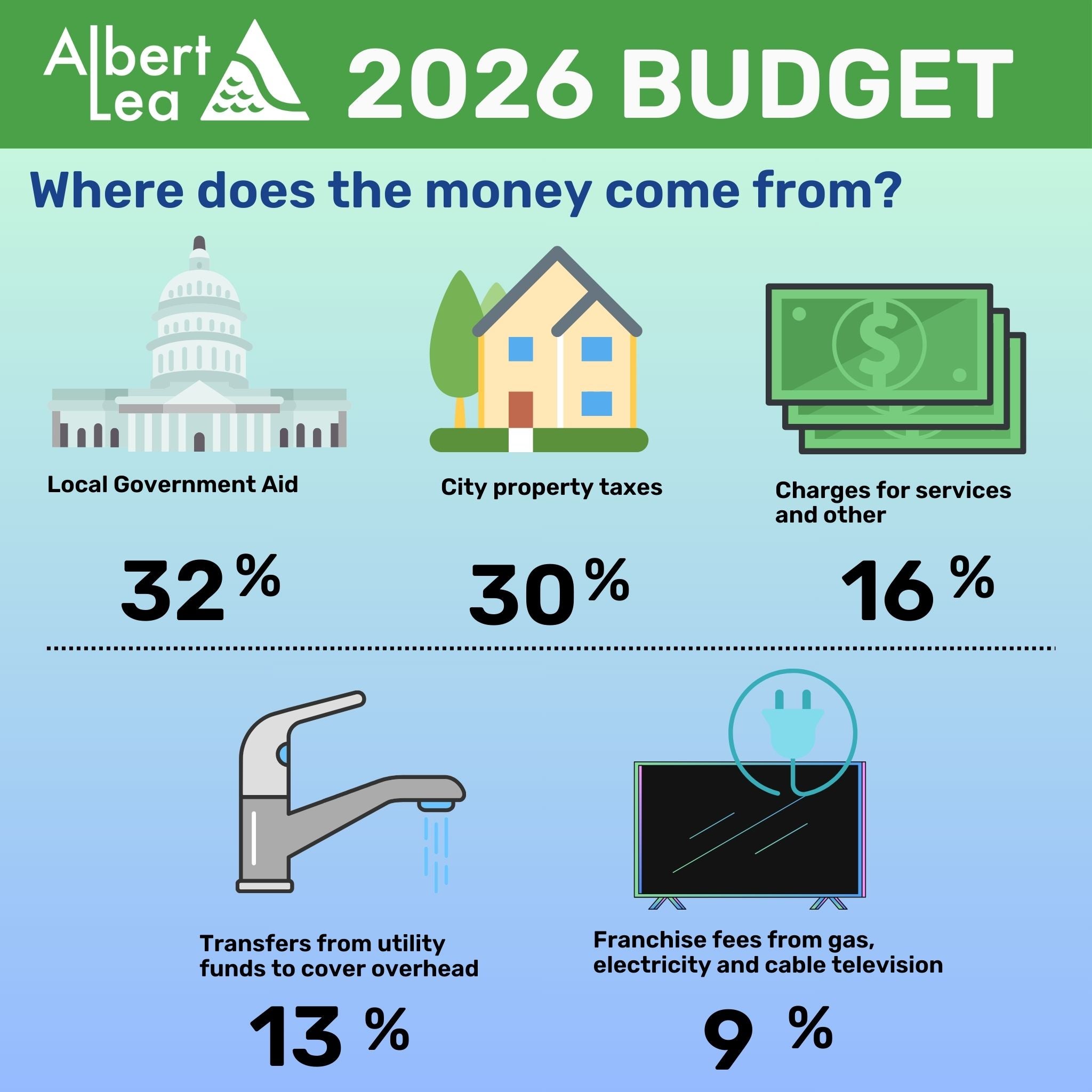

At its meeting Monday, the Albert Lea City Council will consider lowering its property tax levy for 2026 by nearly $200,000, from $9.5 million proposed in September to $9.3 million. While still proposing a levy increase, it would be lower than first proposed, from 8.0% to 5.9%.

The impact to individual homeowners depends on the property valuation set by Freeborn County:

- If the valuation stays the same, then city property taxes would actually decrease. That’s because the city has seen an increase in development and property values. In other words, the tax burden is spread among a higher number and higher value of properties.

- If the valuation has increased, then city taxes will also increase.

- Increases in property valuations are driving many of the steep tax increases that residents are reporting. To ask questions about the valuation process, call the Freeborn County Assessor’s Office at 507-377-5176.

Also Monday, the council will adopt its fee schedule for 2026, including a 6% increase in water and sewer fees to keep saving for rebuilding the wastewater treatment plant and other projects. The average utility bill would increase by $5 per month from $83 to $88.

The council will vote on the final levy and fees after its truth in taxation hearing Dec. 8 at 7 p.m. in the council chambers on the top floor of City Hall, 221 E. Clark St. To ask questions or provide comment, attend the meeting or contact your city councilor directly. The meeting will also be live and posted as a recording on ALTV and YouTube.