Keep collecting special sales tax for regional projects?

Since 2005, consumers purchasing taxable items in Albert Lea have paid an extra half-cent in sales tax. Called a “local option sales tax,” it adds half a cent for every $1 in purchases. That amounts to 5 cents on a $10 purchase or 50 cents on a $100 purchase.

The City of Albert Lea collects that sales tax for the Shell Rock River Watershed District to use for lake improvements.

In February 2026, the sales tax will expire when reaching its maximum of $30 million in revenue.

With the tax expiring, the Albert Lea City Council is considering extending it to continue watershed funding and pay for other regional projects.

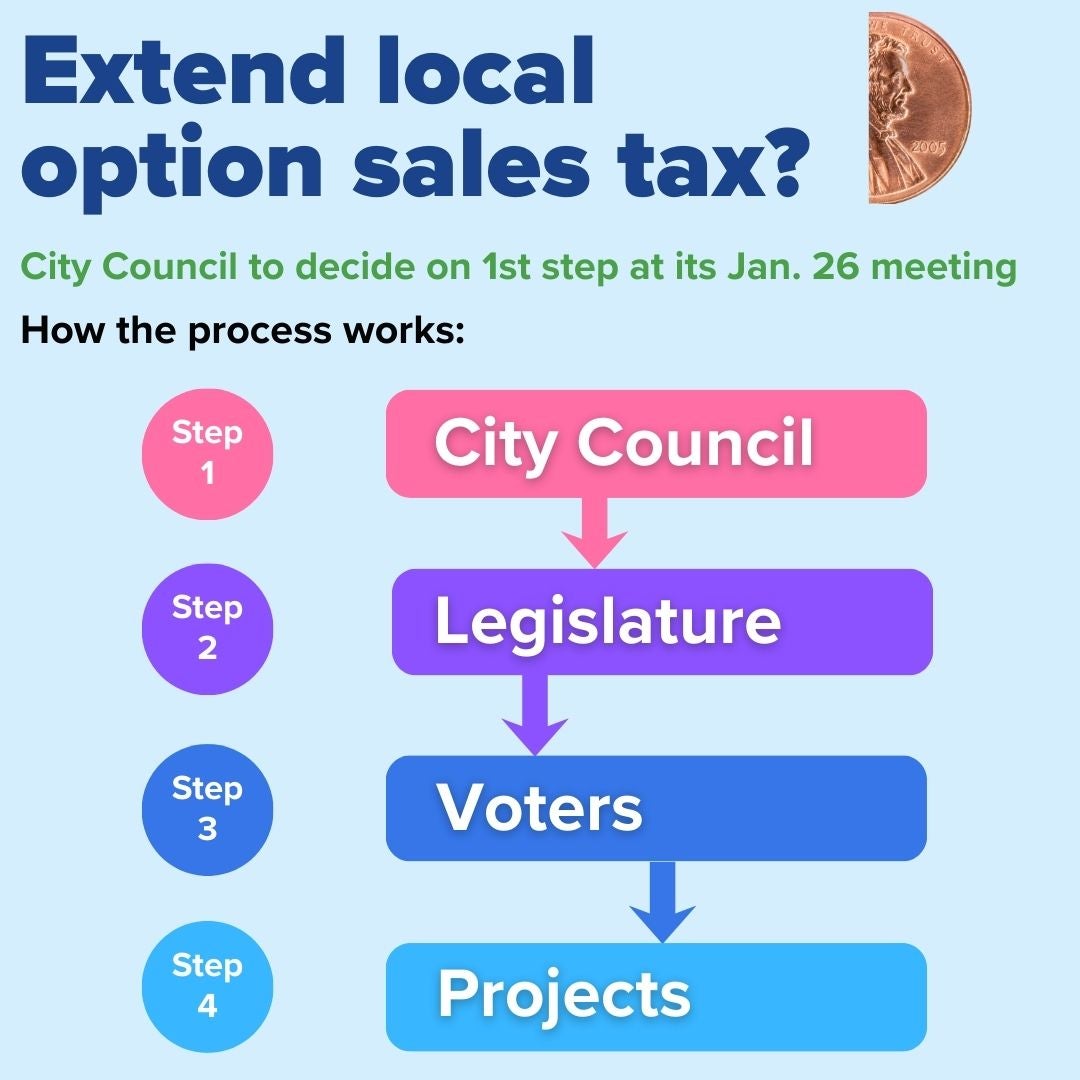

The process requires approval at three main steps:

- The council must pass a resolution to ask the Minnesota Legislature for approval and list the regional projects it would fund.

- The Legislature must approve the sales tax and the list of projects for voters to decide.

- Albert Lea voters decide on each project as listed on the general election ballot in November 2026. If voters approve, the city would start collecting the tax again in 2027.

The council will decide on the first step – including which projects to seeking funding for – at its Jan. 26 meeting.

FAQs

What is up for city council approval?

The council will vote on a resolution supporting a request to the Minnesota Legislature for permission to place a half- cent – 0.5% – local option sales tax before voters.

This action does not enact a tax.

What is a local option sales tax?

A local option sales tax is a city-specific sales tax that can only be used for voter-approved projects. It requires special authorization from the Minnesota Legislature and approval by local voters.

Is this a new tax?

No. Voters first approved this half-cent sales in 2005 to fund watershed projects. Voters approved renewing it in 2016. It will expire in February 2026, meaning consumers will no longer pay it unless it is extended.

Several steps must occur before any tax could be imposed:

- City council requests permission from the Minnesota Legislature.

- The Legislature approves the tax and the list of proposed projects.

- Local voters approve it during a general election.

How much is the proposed tax?

The proposal is for a 0.5% sales tax, which is half a cent per $1 purchased. For example:

- 5 cents on a $10 purchase

- 50 cents on a $100 purchase

How long would the tax last?

The tax would be in place for 30 years or until $40 million is raised, whichever comes first. The soonest it would go into effect would be 2027.

What projects would be funded?

The proposal includes five projects, each of which would appear as a separate ballot question. The is considering place the following projects on the ballot.

- Shell Rock River Watershed District: Water quality improvement projects.

- Songbird Trail: Matching funds for grants to build the trail along the former rail corridor from Albert Lea to Hartland. This is a joint project with Freeborn County.

- Albert Lea Public Library: Expand the second-floor library space into the former firefighter quarters at City Hall for more programming space, family-friendly restrooms, and safety and efficiency upgrades.

- Snyder Field Complex: Replacing the restrooms, paving the parking lots, adding sidewalks and other improvements for accessibility. Adding pickleball courts on the north side of Hershey Street.

- Miracle Field at Edgewater Park: Building this accessible ballfield next to the Inclusive Playground and adding restrooms.

Voters would approve or reject each project individually.

How much would each project receive?

This is the proposal up for council consideration:

- Shell Rock River Watershed District Plan – $20 million

- Songbird Trail – $9.7 million

- Albert Lea Public Library – $4.5 million

- Snyder Field Complex – $4.7 million

- Miracle Field – $1.1 million

Why use a sales tax instead of property taxes?

A local sales tax helps share the cost with visitors and regional users, not just local property owners. The city has documented that these projects provide regional benefits, meaning people from outside the city also use and benefit from them.

Can the city use it for the wastewater treatment plant?

No, the sales tax must fund projects that meet a regional criteria. The wastewater treatment plant is not considered a regional project.

Who pays the sales tax?

Anyone who makes taxable purchases in the city pays the tax, including:

- Residents

- Visitors

- Commuters

- Shoppers from surrounding communities

When would voters see this on the ballot?

If legislative approval is granted, the city must place the questions on a general election ballot within two years, which would be Nov. 3, 2026.

Can the city change or add projects later?

No. Only the projects specifically approved by voters may be funded, and only up to the approved amounts.

What happens if voters reject one or more projects?

Only the projects approved by voters would move forward. Rejected projects would not be funded by the sales tax.

Can the money be used for general city expenses?

No. State law restricts the use of funds to only the projects approved by voters, including related debt and administrative costs.

How will the city ensure transparency?

The city will:

- Track revenues and expenditures by project

- Provide public reporting

- Follow all state auditing and compliance requirements

What happens if the tax generates enough money early?

If the tax generates $40 million before 30 years, the tax must end early.

How can I stay informed?

- Attend council meetings the second and fourth of each month, 7 p.m., at City Hall, 221 E. Clark St.

- Subscribe to the Week-Lea, a free email newsletter.

- Follow the City of Albert Lea on Facebook or Instagram.

- Contact your city councilor.

What roles does the Minnesota Department of Revenue play?

The Minnesota Department of Revenue would administer and collect the local sales and use tax on behalf of the city.

Questions on registering, calculating, collecting, reporting and filing the current tax should be directed to:

Minnesota Department of Revenue

Mail Station 6350

St. Paul, MN 55146‐6350

651‐296‐6181 or 1‐800‐657‐3777 (toll‐free)

salesuse.tax@state.mn.us